Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Introduction

Apple (

AAPL) has the whole investment community jumping up and down over whether or not the company is even a viable investment anymore. Some complain about the sheer size of the company, others blame competitive factors; some are busy fiddling with whether or not Apple is a festering black swan event. Traders on the floor are busy shouting about the technical chart-set ups without a modicum of interest in the fundamentals of the stock. While pure fundamentalist continue to reiterate the growth of the stock, the strong balance sheet, and the future potential of the company. Everyone is arriving at their own conclusion with regards to Apple, and how it should be traded. I on the other hand believe that Apple is a compelling investment that investors should stay invested in. Apple will add hundreds of billions in

market capitalization over the next five years.

Qualitative Analysis

There are three limiting factors that are keeping Apple's stock price from showing substantial improvement.

- Management

- Fund Inflows

- Cash on the balance sheet

One of the mains reasons investors are not bidding the value of the company up is that investors are really concerned over whether or not Tim Cook is capable of identifying and executing on golden

business opportunities. What is worrisome is that his predecessor (Steve Jobs) did a phenomenal job of this, the company only experienced periods of rapid growth when Steve Jobs was operating the business as the CEO. Leadership is a very valid concern and I really have to disagree with

Ashraf Eassa:

It is important for investors to stop blaming Tim Cook for not doing what needs to be done. He's doing exactly what he needs to in order to keep the company performing as well as it can, given the market environment.

Tim Cook has to do a much better job. Major mistakes have been made under Tim's leadership, such as: issuing dividends, falling short with the

Apple iPhone 5 roll out, new product release schedules falling behind the competition. The innovation is also taking a hit, Apple's "revolutionary product" was a miniaturized version of the iPad, while I believe the Apple iPad mini will be sold, I also believe that the product fell short of the master stroke.

The negativity I have towards the management does not mean I have a vote of no confidence for the management. It just means that Apple could have been commanding a much higher market valuation if Steve Jobs were still alive and operating the company. In 2008 - 2010 the company had a P/E multiple of 18.28 - 18.69. All the detail surrounding Steve Jobs and his sickness were completely shrouded in mystery, and then all of a sudden details started to emerge. Generally, investors are unwilling to pay for a less-skilled, less-capable leader which is contributing to a 10.4 P/E multiple. The P/E multiple declined by 44% between when Steve Jobs was leading the company and the current CEO, Tim Cook. Furthermore, an 18 P/E multiple is a reasonable market valuation for a stock that has been growing earnings by 71.66% per year over the past five years.

Tim by himself is not the most amazing leader on planet earth, let's be brutally honest he does not conjure up images of Alexander the Great, Napoleon, or King Solomon. Just because Tim is not as good as Steve Jobs, it does not necessarily mean that Tim's leadership is only worth a 10.4 multiple over earnings. Tim has been with Apple for 15 years, so the company is not being entrusted to someone who does not understand the company. What it does mean though, is a lowered set of expectations for the company going forward. Analysts on a consensus basis anticipate Apple to grow its earnings by 18.98% over the next 5 years, with the company having been able to grow earnings by 71.66% over the past 5-years one may wonder if expectations are a little too low on this company. I think that if Tim Cook is able to exploit small yet realistic growth opportunities in foreign markets, while continuing to improve the Apple product platform, investors could still net a very reasonable amount of growth in earnings that could outpace analyst expectations. The devotion customers have to the Apple brand is unprecedented; it makes the Tulip mania look like a joke. So yes, we're working with a very predictable, lovable, and cheerful customer base. Apple investors have the best customers any company on planet earth could honestly ask for, and Tim Cook will not mess that up.

Some of the issues surrounding the market valuation is more macro and is beyond the control of Apple and its management.

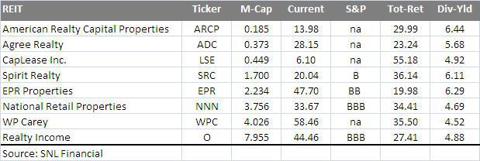

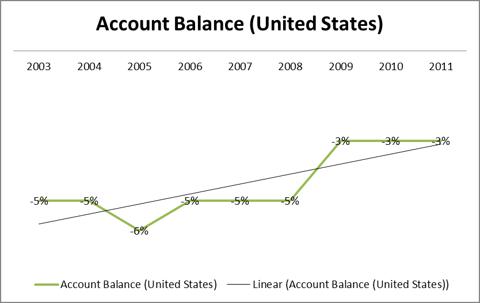

(click to enlarge)

The United States has been able to decrease its negative account balance from -5% to -3% between 2003 and 2011. This is important because the account balance of the United States measures the amount of cash inflows and outflows (difference between imports and exports). The more cash that is being out-flown the less savings available to invest into investment securities like Apple. Since Apple is a really large company in terms of market capitalization ($432.1 billion), the amount of savings available to invest into stocks becomes a contributing factor as to whether or not the stock can fetch a more reasonable market valuation. This can further explain the reason for why the stock has a price to earnings growth ratio of 0.6. It is not that investors do not understand the future potential of the stock, but that there is not enough savings within the United States economy to further support the valuation of the stock. This does not mean that Apple is a bubble, what it means is that there must be more savings in the United States economy in order for the stock to trade at a higher valuation. In the account balance chart, the linear line had an upward slope, meaning that account balances are improving in the United States. This is a positive for Apple because there will be even more savings within the United States, and with improved savings leads to further fund inflows. More fund inflows means more investors investing their hard earned cash into Apple. Apple's stock value is directly tied to the amount of savings in the United States economy, so it is a reasonable assumption that if saving improve, Apple's stock value will also improve.

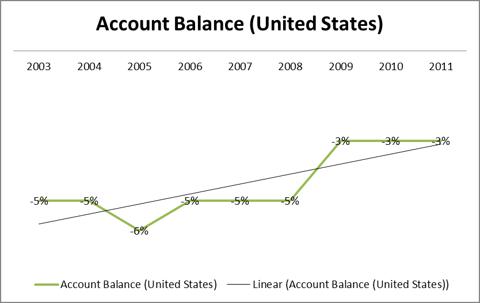

(click to enlarge)

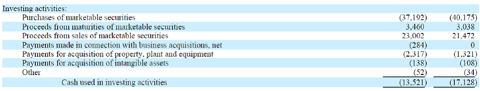

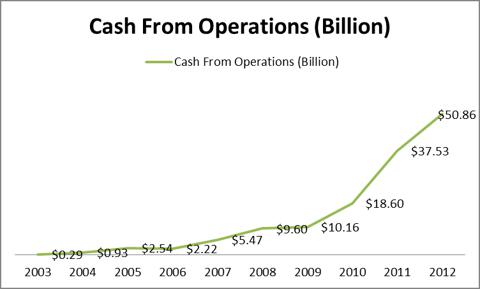

Many fundamentalists would argue that the above figure is a great chart. The only problem with the cash coming in from operations is that Apple invests the cash into low-risk, low-yield treasury bonds. This type of investment behavior is unacceptable especially because the cash from operations will drastically increase in subsequent years. Anyone who receives a dividend from Apple can go and buy a treasury bond, this does not take skill nor rocket science. Apple currently generates enough cash from operations that it can buy-out a $50 billion company every single year. Almost every large/mega-cap stock on the stock market could generate higher yields than a treasury bill. In fact, Apple might as well buy-out Berkshire Hathaway, and then allow Warren Buffet and Charlie Munger to manage all of Apple's cash from operations. That last sentence was a joke, but if Warren Buffet were to manage the cash balance on Apple's cash flow statement, the stock would literally climb double digits overnight.

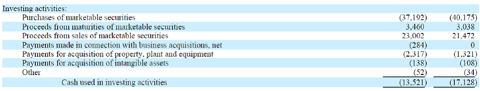

The point I am really trying to make is that Apple with its humongous cash balance on its balance sheet could end up doing an amazing job of investing its capital. This is how Apple invests its cash, according to Apple's

annual report:

The Company's marketable securities investment portfolio is invested primarily in highly-rated securities and its investment policy generally limits the amount of credit exposure to any one issuer. The policy requires investments generally to be investment grade with the objective of minimizing the potential risk of principal loss. As of September 29, 2012 and September 24, 2011, $82.6 billion and $54.3 billion, respectively, of the Company's cash, cash equivalents and marketable securities were held by foreign subsidiaries and are generally based in U.S. dollar-denominated holdings.

Apple's investment activities could generate substantial yields. Apple will report its assets at mark-to-market value; this was regulation that was imposed in order to improve liquidity by the FASB (Financial Accounting Standards Board) in 2009. By imposing this standard, Apple is able to speculate on the value of securities, and is able to record the paper gains without fully realizing them.

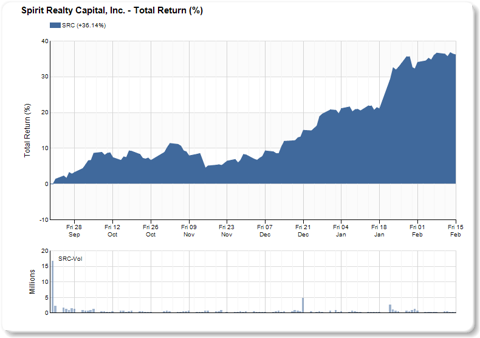

(click to enlarge)

If I were a consultant, providing advice to Apple on what type of levered or non-levered buy-out it should proceed with. I would set three criteria. First it must have scale (no point in buying out a $300 million company and expecting a significant move in the stock). Second it must have high net-profit margins or potential for high profit margins. Third there must be limited conflict with the businesses operations. Google's (

GOOG) buy-out of Motorola Mobility met my criteria of a good buy-out. This also presented a strong case for why investors should remain confident in Google's ability to use its end of period cash balance. In fact, after the Motorola buy-out, Google's stock has trended higher (based on the chart below).

(click to enlarge)

What this means is that Apple could potentially change investor sentiment by doing what Google did. A major buy-out of another company that strategically adds to Apple but also has a significant impact on Apple's cash balance. If Apple met that criteria it could have a drastically positive effect on the price of the stock and the sentiment around the company.

I remain highly confident in Apple. The company's operation generates a substantial amount of cash flow. Management is competent and will sustain a reasonable rate of growth for investors. In fact it is likely that Apple's management could surprise analyst expectations leading to sudden surges in valuation. Furthermore, Apple could productively use its cash by doing a high profile buy-out worth tens of billions of dollars, this way investors can at least anticipate an avenue of added growth. Apple's current investment activities could add substantially to Apple's net-income in future years. Not to mention the United States account balance is in an up-trend meaning that investment inflows will increase, adding further support to the price of Apple's stock in subsequent years. These factors combined makes me optimistic on Apple.

Technical Analysis

Many technical traders have been providing a lot of commentary on the head and shoulder formation. I don't think that just because the stock fell below $500 it will stay there for a pro-longed period of time. I believe that investors will eventually realize that there's an arbitrage opportunity between the intrinsic value of the stock and the actual price of the stock. The stock is likely to recover from its recent sell off from $700 per share.

(click to enlarge)

The stock is trading above the 200-Day Moving Average while trading below the 20-, 50-Day Moving Average. The stock is in a confirmed down-trend (lower highs, lower lows). This down-trend will not sustain itself for long because the underlying intrinsic measures indicate otherwise. Over the short-term the stock may experience further declines, but over the long-term Apple stock will re-coup all of its losses and trade at new all-time highs based on the price forecast (later in the report).

Notable support is $325, $375, and $440 per share. Notable resistance is $500, $550, and $700 per share.

Street Assessment

Analysts on a consensus basis have high expectations for the company going forward.

Growth Est | AAPL | Industry | Sector | S&P 500 |

Current Qtr. | -16.70% | -10.90% | N/A | 11.20% |

Next Qtr. | 5.00% | 5.50% | 1005.90% | 17.30% |

This Year | 1.40% | 4.20% | 39.50% | 9.50% |

Next Year | 13.70% | 12.40% | 21.50% | 12.50% |

Past 5 Years (per annum) | 71.66% | N/A | N/A | N/A |

Next 5 Years (per annum) | 18.98% | 13.05% | 17.54% | 8.71% |

Price/Earnings (avg. for comparison categories) | 10.43 | 28.41 | 9.42 | 15.88 |

PEG Ratio (avg. for comparison categories) | 0.55 | 1.74 | 1.58 | 2.09 |

Analysts on a consensus basis have a 5-year average growth rate forecast of 18.98% (based on the above table).

Earnings History | 12-Mar | 12-Jun | 12-Sep | 12-Dec |

EPS Est | 10.04 | 10.37 | 8.75 | 13.47 |

EPS Actual | 12.3 | 9.32 | 8.67 | 13.81 |

Difference | 2.26 | -1.05 | -0.08 | 0.34 |

Surprise % | 22.50% | -10.10% | -0.90% | 2.50% |

The average surprise percentage is 3.5% above analyst forecasted earnings over the past four quarters (based on the above table).

Forecast and History

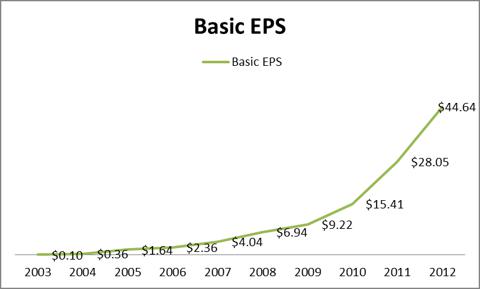

Year | Basic EPS | P/E Multiple |

2003 | $ 0.10 | 105 |

2004 | $ 0.36 | 51.03 |

2005 | $ 1.64 | 31.97 |

2006 | $ 2.36 | 30.48 |

2007 | $ 4.04 | 36.17 |

2008 | $ 6.94 | 18.28 |

2009 | $ 9.22 | 19.65 |

2010 | $ 15.41 | 18.69 |

2011 | $ 28.05 | 14.2 |

2012 | $ 44.64 | 15.31 |

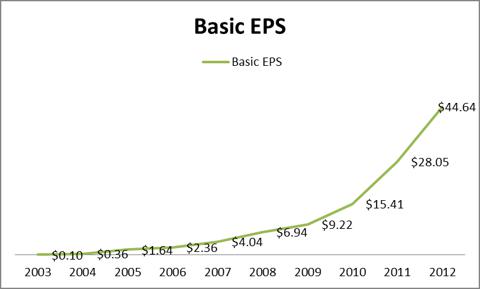

The EPS figure shows that throughout the 2003- 2012 period, the company was able to grow earnings.

(click to enlarge)

Source: Table created by Alex Cho, data from YCharts. By observing the chart we can conclude that the business has a unique business model because it is able to grow earnings even through economic recessions. I also believe that so as long as the United States account balances continues to improve, the company will generate reasonable returns over a 5-year time span based on the forecast below.

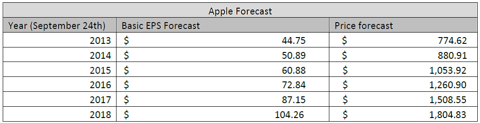

(click to enlarge)

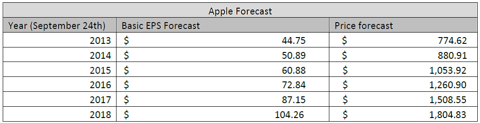

Source: Forecast and table by Alex Cho.

By 2018 I anticipate the company to generate $104.26 in earnings per share. This is because of cost management, potential buy-outs, investment activities, growth in foreign markets, improving economic outlook, and its unique product offering.

The forecast is proprietary, and below is a non-linear chart indicating the price of the stock over the next 5-years.

(click to enlarge)

Source: Forecast and chart by Alex Cho.

Below is a price chart incorporating the past 10 years and the next 6 years. Detailing 16 years in pricing based on my forecast and price history on September 24th of each year.

(click to enlarge)

Source: Forecast and chart created by Alex Cho, data from YCharts, and price history is from Yahoo Finance. Investment Strategy

AAPL currently trades at $460.16. I have a price forecast of $774.62 for December 31st 2013. I believe that the stock is heavily under-valued over the short-term. Therefore investors should anticipate sudden surges in valuation.

Short Term

Over the next twenty-four months, the stock is likely to appreciate from $460.16 to $774.62 per share. This implies 68% upside from current levels. The stock is in an up-trend, which further supports my investment thesis.

Investors should buy Apple at $460.16 and sell at $774.62 in order to pocket short-term gains of 68% between 2013 and 2014.

Long Term

The company is a decent investment for the long-term. I anticipate AAPL to deliver upon the price and earnings forecast despite the risk factors (competition, economic environment, going concern). AAPL's primary upside catalyst is improving economics, international growth, investing activities, and potential buy-out opportunities. I also disregard much of the over-blown pessimism surrounding the stock. I anticipate the company to deliver upon my forecasted price target of $1,804.83 by 2018. This implies a return of 292% by 2018. This is an exceptional return on investment for a computer hardware company.

A higher yielding investment opportunity albeit having higher risk is to buy the Jan 17, 2015 calls at the $470.00 strike. The call premiums trade at $67.90. The price forecast for the end of 2014 is $880.91. The rate of return if the calls expire at $880.91 is 505%, the option will break-even when the stock trades at $537.90.

The risk to reward ratio on the option strategy is phenomenal. The high-returns come with moderate risk (5-year beta of 1.0).

Apple has a market capitalization of $432.1 billion; the added liquidity makes this an investment opportunity appropriate for larger institutions that require added liquidity.

Conclusion

The party is not over in Cupertino California. Apple will thrive, even without Steve Jobs. Apple and its employees embody Steve's spirit and that in of itself is what will keep Apple on the right path for many years to come.

The conclusion remains simple: buy Apple.