Pick A Healthy Triple-Net REIT And Don't BuyThis Lemon

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

One of the good things about REITs today is that the broader market is making it increasingly easier to diversify. With a wave of IPOs forming and new REITs listing shares, the number of publicly-listed REIT options is blooming into a wide array of appetizing - and some not so appetizing - selections.

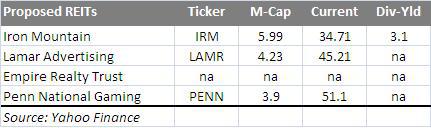

Currently there are 129 U.S. equity REITs with a combined market capitalization of around $561 billion and there are 28 U.S. mortgage REITs with a combined market capitalization of around $65 billion. I have written about several proposed new REIT listings lately including Iron Mountain(IRM), Lamar Advertising (LAMR), Empire State Realty Trust, and Penn National Gaming (PENN).

Last week I wrote a Forbes.com article on the Empire State Realty Trust and in a Q&A interview Anthony Malkin, President and CEO of Malkin Holdings, explained his company's value proposition for listing shares of the 19 property portfolio (the first NYC area REIT listing in over 16 years).

This unlocks investors from an archaic investment structure while giving them several good options and benefits, including the chance to trade into a portfolio of trophy pre-war, Manhattan-area assets on a 100% tax-deferred basis… these are benefits that they do not have now. By allowing investors to hold interests listed on the New York Stock exchange, this transaction offers a new found path to liquidity, so an investor can sell at an efficient market price. All sales to date have been at what we think are tremendous illiquidity discounts to value.

The demand for broader diversification is warranted and over the last few weeks several companies have made it to the full-liquidity finish line. These new publicly-listed REITs include Gladstone Land Corporation (LAND),CyrusOne Inc. (CONE) - see Lou Basenese's article here; Silver Bay Realty Trust (SBY) - see Regarded Solution's article here; and Spirit Realty Capital (SRC) - see my article here. In addition, I have written on several REITs that listed shares last year including AmREIT (AMRE) andWheelerREIT (WHLR).

Triple-Net REITs Should Be a Primary Food Group

Last week I wrote an article on diversification and in the article I explained that by "filtering a diverse landscape of REITs" and by using a "rigorous 'margin of safety' application" an investor could "achieve the most favorable results". As I explained:

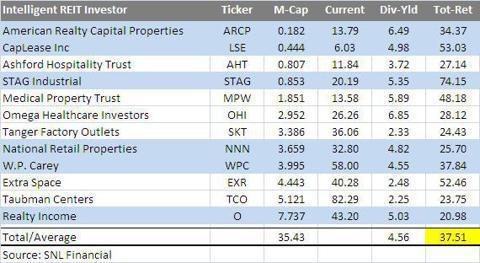

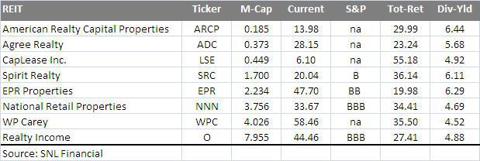

My portfolio was designed for modest diversification (like Buffett) and I have over-weighted the REIT sectors with a highly defensive concentration of triple-net REITs. As most of you know, I am a bullish proponent of the stand-alone asset sector as I believe the sustainability fundamentals (i.e. contractually long-term leases) provide for an attractively well-balanced value proposition: stable dividends and moderate growth.

In my portfolio that returned 37.51% (and also beat the other mutual funds and ETFs), I included 6 out of 12 triple-net REITs. The reason for this over-weighted triple-net diversification strategy was simply the fact that I was aiming for a highly defensive composition that could deliver sustainable dividend performance. Unlike the variety of volatile mortgage REITs - likeAnnaly Capital (NLY), Armour Residential (ARR), or Chimera Investment Corp. (CIM) - I wanted to demonstrate that my portfolio could outperform the more diverse funds simply by reducing volatility and focusing on safer dividend-weighted total return metrics.

So many investors today are chasing yield and simply missing the most important goal of "sleeping well at night". Warren Buffett seems to think that modest diversification combined with consistency makes for a more sustainable investment model:

If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value.

Picking a Healthy Triple-Net Alternative

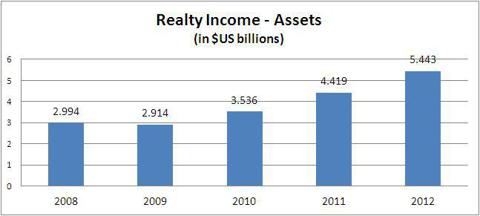

Last week Realty Income (O) announced its fourth quarter (2012) performance and, as suspected, the "monthly dividend company" finished the year with very successful financial results.

Funds From Operations (or FFO) available to common shareholders was $71.6 million, or 54 cents per share, compared to $68.1 million, or 51 cents per share during the fourth quarter of 2011. Adjusted Funds From Operations (or AFFO) totaled $72.9 million, or 55 cents per share, compared to $68.5 million, or 52 cents per share, in the prior-year period, marking increases of 6.4% and 5.8% on aggregate and per-share bases, respectively.For the year, Realty Income's FFO totaled $260.9 million, or $1.96 per share, compared to $249.4 million, or $1.98 per share, in 2011. The company attributed the per-share decrease to a $3.7 million noncash redemption charge on the redemption of class D preferred shares in March 2012 and $7.9 million of merger-related costs. FFO totaled $1.99 per share excluding the redemption charge.

For the full year 2012, Realty Income purchased $1.6 billion in properties comprised of 423 stand-alone assets. That is another milestone for the company as it is the largest growth recorded in any calendar year, surpassing the company's previous record of $1.02 billion in 2011 (The full year acquisitions were done at an average cap rate of 7.22% with a weighted average lease term of just over 14.5 years).

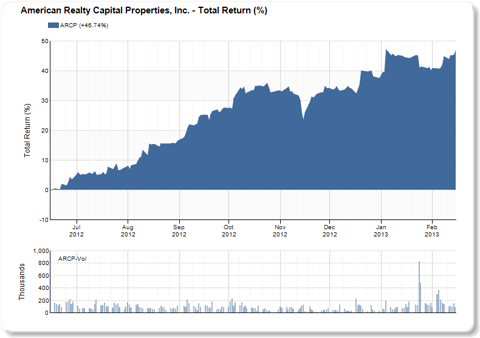

Another triple-net REIT, American Realty Capital Properties (ARCP), is quickly becoming a valuable SWAN (sleep well at night) alternative for investors. The company listed shares on NASDAQ on September 7, 2011 and since that time the New York-based REIT has delivered "nothing but net". I recommended (in an article) ARCP on June 15, 2012 and since that time the small-cap REIT has returned over 46%.

Last week ARCP announced that it was getting closer to its goal of merging with a related non-traded REIT, American Realty Capital Trust III. In a press release, ARCP said that the proposed merger is expected to close earlier than previously expected, in the first week of March (2013).

As a result of the early closure, American Realty Capital Trust III stockholders will receive an increased distribution. As explained in the press release:

Following a vote by the stockholders of both companies at the special meeting scheduled for Feb. 26 in favor of the merger, American Realty Capital Trust III stockholders who elect to receive common stock in American Realty Capital Properties will receive an increase of 20 cents per share to their current annualized distribution, reflecting an annualized rate of 86 cents per share, beginning with the March distribution.Pursuant to the terms of the merger, each outstanding share of common stock of American Realty Capital Trust III will be converted into a right to receive either 0.95 of a share of common stock of American Realty Capital Properties or $12.00 in cash, but in no event will the aggregate consideration paid in cash be paid on more than 30% of the shares of American Realty Capital Trust III's common stock issued and outstanding immediately prior to the closing of the merger.

Also announced last week, American Realty Capital Trust III has signed an $875 million credit facility, which can be increased to $1.0 billion. The credit facility includes a $525 million term loan facility and a $350 million revolving credit facility. Loans under the facility will be priced at their applicable rate plus 160 basis points to 220 basis points.

At the completion of the merger, ARCP will have access to the credit facility along with its current financing, giving the combined entity access to up to $1.2 billion. The combined annual revenue will be around $180 million with an equity market cap of around $1.894 billion. That translates into a conservative net debt to enterprise value of 40.9%.

I like the merger and I explained the value proposition in a recent article:

ARCP is no longer a "Mickey Mouse" REIT and the discipline of the experienced management team will determine the company's destiny: to become a durable sleep well at night REIT. The growing high-quality tenant composition and continued revenue diversification will have an enduring impact that should allow the triple-net REIT to replicate the success of the stalwart peer group (O, NNN, and WPC).

Don't Eat Too Much Junk Food

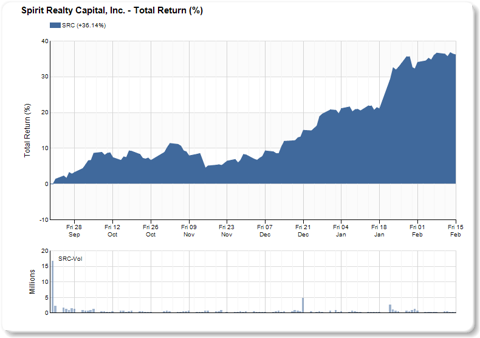

Remember, just because a company is considered a defensive triple-net REIT does not guarantee it success. Back in September I wrote an article onSpirit Realty's IPO:

Spirit spooks me and that is why it is important to compare cost of capital and consider investing in established companies - a proposition that delivers safety in principal and repeatable dividend performance. These higher quality REITs (like Realty Income, National Retail Properties, and W.P. Carey) are proven fixed-income alternatives and accordingly enjoy sustainably robust dividend yields.

And now, and after the recently announced merger with Cole Credit Property Trust II (CCPT II), I don't see the value in the triple-net marriage. As I wrote:

CCPT II was looking hard for love since "many of the non-traded REITs like CCPT II have become "long in the tooth" as they have not been able to exit the market due to the baked-in costs (fees) and cap rates that are seemingly "under water…In reviewing the CCPT II portfolio, it is clear that many of the properties in the portfolio are non-investment grade and due to the size of the portfolio it could be difficult for one buyer to stomach the broad composition of credits, especially since the valuations are likely to be nowhere close to the recent valuations driving O/ARCT and ARCP/ARCT III.

Simply said, the proposed merger with Spirit Realty and Cole Credit Property Trust II is going down for ALL OF THE WRONG REASONS. True, Spirit needs to add high-quality assets to its highly-concentrated sub-prime portfolio; however, I don't feel like there is value in merging Spirit's toxic net lease portfolio with the highly-leveraged Cole Credit Property Trust II portfolio.

Remember REIT gamers: Non-Traded REITs make money when they BUY assets. Cole Credit Property Trust II was built on the backs of retail investors and therefore CCPTII's management team is incentivized to acquire larger deals using leverage. CCPTII has around $3.43 billion in assets (2% acquisition fee = $68 million) and the debt load is around $1.768 billion. In other words, Spirit is merging its low quality portfolio with CCPTII's highly-leveraged "diversified" portfolio (debt to gross assets is 50.31%).

It's no secret that non-traded REITs raise equity by charging fees (load) and in the case of CCPTII the fees amounted to around 9% or $144 million. Add the acquisition fees and that is over $200 million.

Comparatively speaking, ARCTIII's non-traded REIT portfolio has assets of $1.654 billion and total debt of $157 million. In addition, ARCTIII and ARCP's combined portfolio will include 77% of tenants that are investment grade rated. (ARCTIII's debt to gross assets is 16.58%). ARCTIII collected acquisition fees of 1% or around $16.5 million.

Recently Stifel Nicolaus & Co. analyst Joshua A. Barber downgraded his investment opinion of Spirit to "hold" from "buy" (source: SNL Financial):

We had previously viewed SRC shares as the value play in the triple-net sector, and after the recent run-up, we think further appreciation would require SRC shares to trade like higher-quality triple-net peers, which we think is unlikely even after the merger given the still-higher leverage and tighter dividend coverage. The deal solves several of Spirit's pressing issues. First, top 10 tenant concentration drops from 52% to 37%, and Shopko exposure (still the largest tenant) falls from ~30% to a more manageable ~16%. Investment grade tenants now make up 19% of rents from essentially nothing.

Check Under the Hood So You Don't Buy a Lemon

I'm sure you've heard the saying:

When life gives you lemons, make lemonade.

Well, that's not necessarily true. I mean, life does not have to give you lemons. If you conduct ample due diligence before buying you are likely to enjoy the fruits of your labor, instead of lemons. In the case of the proposed merger with Spirit Realty and CCPTII it is clear to see that the combination is simple one big lemon.

Remember that Mr. Market does not know the difference between a lemon and lemonade. Conversely, investors should make sure to carefully examine the safety of the income stream and determine whether "an investment operation is one which, upon thorough analysis, promises safety of principal and satisfactory return".

In my view, the Spirit/CCPTII operation does not meet these requirements and is therefore highly speculative. Therefore, I believe that Spirit shares involve considerable peril - at any price. There are too many other triple-net REITs that provide more stability and consistency. Don't let your enthusiasm for Spirit become your next "silly willy" dance. As Ben Graham explained (in 1949):

Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you little short of silly.

No comments:

Post a Comment